|

People, Economy and the Pandemic

Soumyabrata Basu

“Why an element is contagious, when it may even "go viral," may be hard to understand, unless we reflect carefully on the reason people like to spread the narrative. Mutations in narratives spring up randomly, just as in organisms in evolutionary biology, and when they are contagious, the mutated narratives generate seemingly unpredictable changes in the economy.” (Shiller 2017)

After its first reported case late last year the Coronavirus disease has spread well beyond its epicenter and has now earned the title of a pandemic. This sudden outbreak of an infectious disease will affect the lives of thousands across the world. To us, lives are nothing but economic agents and when they get affected it is evident that the economy will face its consequences.

Let us first consider how economic agents react to situations as ‘risky’ as a pandemic. Now, whether a situation is ‘risky’ or not can have various factors associated with it. In ‘Freakonomics’ Levitt and Dubner mentions that risk can be expressed as; Risk = Hazard + Outrage. When hazard is high and outrage is low people underreact. In a case like that of coronavirus both hazard and outrage can assume equal weights because neither can we ignore the hazard nor can we ignore the necessity of an outrage to spread awareness. Another factor is the use of ambiguous adjectives, percentages and probabilities that makes it difficult for common people to build a fair idea regarding the prevailing scenario. In such circumstances the state must keep its citizens updated with informations so that people do not make assumptions and take decisions on their own, which are often not optimal.

Whether the virus can survive different climatic zones or not, whether the virus mutates or not is still not clear and it is this lack of trustworthy information that has led most countries to declare a statewide lockdown or to impose travel bans. For some, such restrictions are essential and for others it may just be based on narratives.

A direct impact of such restrictions fall on labour mobility and labour hours. Labour immobility and imposed reductions in labour hours will cause supply disruptions. China is a manufacturing hub and it also acts as a major source of demand for many commodities. Besides China some major economies are affected as well and so the reduction in global output is inevitable. Even if the situation recovers in these major economies there will not be a sudden spur in production because it takes time for commodities to be shipped from one place to the other.

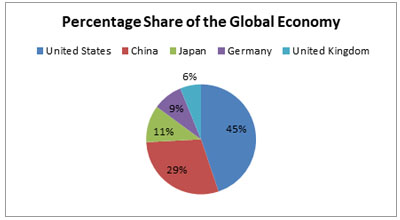

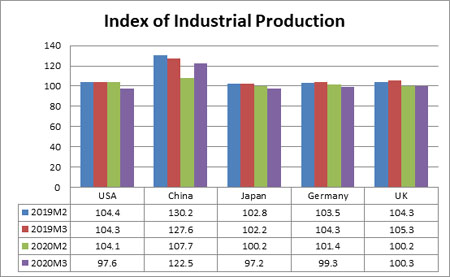

We have analysed the Index of Industrial Production(IIP) (Total Manufacturing) data for some of the major economies of the world. Due to unavailability of data for the month of March in Japan, Germany and United Kingdom we assumed it to decrease by 5% from what is was last year for the same period. We get the 5% mark by observing the data of the other economies for whom the figure for March was available and it showed to have decreased by something around 5%. Figure.1 shows the percentage share of the global economy that our countries of choice enjoys and may thus be a significant indicator of how corona has affected the IIP.

Figure 1: Source: IMF

Figure 2: UNIDO 1

As Figure 2 suggests that the IIP has declined significantly from what it was in 2019. China though faced a steep decline again revived in the month of March while the trend is still downwards for the other countries.

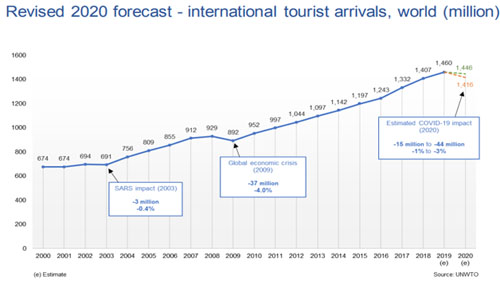

The travel and hospitality industries have faced a steep fall in demand due to travel restrictions. The Centre for Asia Pacific Aviation India (CAPA India) stated that in Q4 of FY20 the Indian aviation industry, except Air India, can incur losses of around $500 million. The OECD ‘Interim Economic Assessment’ report predicts that ‘if the spread of the coronavirus outbreak affects visitor numbers more widely across the major economies, there would be sizeable costs, with tourism accounting directly for 4¼ per cent of GDP in the OECD economies and almost 7% of employment.’

Figure 3: UNWTO

A sense of uncertainty among investors brought about by the spread of the disease and the added effect of the Saudi-Russia oil price war has shaken their confidence, which was reflected in the fall in stock markets worldwide. Nouriel Roubini predicts a 40% fall in global equities. There may be reduction in consumer spending as people being cynical about future economic scenario may try to save and spend only on necessities. Another reason for reduced spending can be the fall in income of daily wage earners. Businesses across the world are laying off workers and in economies where a large share of workforce belongs to the unorganized sector such laying off can have an adverse effect.

Global growth has been sluggish in 2019 with global trade and investment along with the manufacturing activity becoming weaker. Various key economic indicators reached their lowest since the global financial crisis. Adding salt to this injury is the COVID-19 outbreak which is predicted to make things worse. OECD and Moody’s have predicted global GDP to be around 2.4% and 2.1% respectively while some experts are of the opinion that it may even go down to something around 1.5%. A recession may be inevitable.

First and foremost the state should take all precautionary actions to stop the spread of the disease and ensure that people stay at home. Often during such times people do not behave rationally as the “cost of anti-social behaviour (quarantines, maintaining a distance from others) is often considered too high, especially if it requires separation from loved ones” and so they may try to break free thus aggravating the situation. And lastly, experts suggest that the economies should

introduce fiscal stimulus packages to control the economic downturn upto some extent. Abhijit Vinayak Banerjee suggested that the country should print money and transfer cash directly to those who are in need. Our textbooks tell us that seigniorage causes inflation but at this point in time such consequences can be overlooked. Infact the sharing of ‘seigniorage profit’ by the banks among checking depositors, savings depositors and bank borrowers can benefit people

indirectly as they can then enjoy cheaper services in the administration of their accounts, higher interest payments on their deposits and lower interest rates on their loans. Moreover, the interest rate can also be adjusted gradually according to need without worrying too much about inflation. However, this has been countered by the fact that someone may be reluctant to take loans even if interest rates are low, if the entity is not optimistic about how he can utilize the loan taken.

References:

1. Shiller J.Robert, The American Economic Review , APRIL 2017, Vol. 107, No. 4 (APRIL 2017), pp. 967-1004

2. Dubner Stephen J. ,Levitt Steven D., Freakonomics

3. World Economic Forum

4. UNIDO

5. UNWTO

Soumyabrata Basu, MA Economics, St. Xavier’s University, Kolkata

Back to Home Page

Frontier

Aug 31, 2020

Soumyabrata Basu mailsoumyabrata.eco@gmail.com

Your Comment if any

|